- Your Alliance for all your CHC needs.

- (386) 673-9846

- info@thechcalliance.com

August 2023

Ready or Not, Here A.I. Come: How FQHCs Can Benefit from AI Advancements

June 6, 2023

September 2023; RPM (Remote Patient Monitoring)

September 28, 2023Navigating the Future: Key Insights from the CMS Proposed Rule for CY 2024

The Centers for Medicare and Medicaid Services (CMS) recently released its Proposed Rule for the Calendar Year (CY) 2024 Medicare Physician Payment Schedule and Quality Payment Program (QPP). If finalized, these policies will take effect on January 1, 2024. The Proposed Rule Summary not only offers a glimpse into impending changes but also invites feedback from interested parties. The comment period lasts 60 days, concluding on September 11, 2023.

While numerous summaries and articles on the Proposed Rule exist, including the American Medical Association’s (AMA) Summary, we’ve highlighted significant policies with implications for FQHCs and RHCs.

Remote Physiologic Monitoring (RPM) and Remote Therapeutic Monitoring (RTM)

- FQHCs and RHCs will be able to bill G0511 as a stand-alone code for RPM or RTM services. This move removes G0511 from the FQHC PPS or the RHC AIR bundles.

- When time and effort requirements are met, either RPM or RTM (not both) can be separately reimbursed from global services payments for surgery.

Telehealth Services

In 2024, FQHCs and RHCs will continue receiving reimbursement for telehealth services based on PHE (public health emergency) standards, and there are several positive changes:

- CMS is broadening the scope of telehealth originating sites for services to encompass any location in the United States where beneficiaries are present during service, including their homes.

- More practitioners will be authorized to offer telehealth services, such as occupational therapists, qualified physical therapists, qualified speech-language pathologists, qualified audiologists, marriage and family therapists (MFTs), and mental health counselors (MHCs).

- Telehealth outpatient therapy (physical, occupational, and speech-language), diabetes self-management training (DSMT), and medical nutrition therapy (MNT) will continue to be payable, and CMS is removing frequency limits on some subsequent inpatient, nursing facility, and critical care consultation services.

Health-Related Social Needs: PIN, CHI, and SDOH

CMS is extending reimbursement for health-related social needs like Community Health Integration Services (CHI), Social Determinants of Health (SDOH) Risk Assessment, and Principal Illness Navigation Services (PIN) as part of the move toward value-based care. When community health workers, care navigators, and peer support specialists are involved in medically essential care, all three (CHI, PIN, and SDOH) will be separately reimbursable.

- HCPCS code GXXX5 (screening for social determinants of health) will qualify for telehealth reimbursement.

- The SDOH Risk Assessment is being added as an optional / additional element (with an additional payment) to Medicare’s AWV (Annual Wellness Visit).

- The SDOH Assessment can be provided on the same day as an E/M visit as long as the E/M visit is not reported with a -25 modifier.

E/M visits

HCPCS code G2211 has been approved as a separate add-on payment for outpatient office visits, reimbursing providers for treating a patient’s single, serious, or complex chronic condition. However, it won’t be paid if billed with an E/M visit with a -25 Modifier.

Behavioral Health and Health Behavior Assessment & Intervention (HBAI)

Improvements to behavioral and mental health services for FQHCs and RHCs include:

- Marriage and family therapists (MFTs) and mental health counselors (MHCs) will be able to provide Medicare telehealth services.

- Addiction counselors who qualify for MHC status can enroll with Medicare.

- Updated BHI codes will allow MFTs and MHCs to deliver integrated BH care. MFTs and MHCs will join clinical psychologists (CPs) and clinical social workers (CSWs) in billing for general BHI services when such services serve as the main point of care integration.

- New HCPCS codes for psychotherapy (GPFC1 and GPFC2) will apply to crisis services provided anywhere the non-facility rate for psychotherapy for crisis services applies (other than the office setting), including mobile units and a patient’s home (even if the home is temporary lodging).

- CSWs, MFTs, and MHCs will be allowed to bill for HBAI services. Specific codes will cover HBAI services for individuals, groups, and families.

Diabetic Self-Management Training (DSMT) and Diabetes Screening

CMS proposes promising modifications for diabetes screening and DSMT, such as:

- Coverage for the hemoglobin A1C (HbA1c) test for diabetes and prediabetes screening, with a two-test limit per rolling 12-month period.

- Registered dieticians (RDs) and nutrition professionals serving as DSMT-certified providers may bill on behalf of the entire DSMT entity (regardless of which professional individually delivers each part of service). They may also report DSMT telehealth services, even when those services are conducted by others inside the DSMT entity.

- All DSMT training can be delivered via telehealth, removing the requirement for 1 hour of initial DSMT training and 1 hour of annual follow-up training to be face-to-face.

- Beginning July 1, 2023, the Medicare deductible is waived, and coinsurance is limited to $35 for a month’s supply of insulin delivered via a covered DME (for example, an external infusion pump). This means that a three-month supply of insulin for these patients will not cost more than $105. That’s good news!

- CMS is also expanding PHE flexibilities and making other modifications to enhance the Medicare Diabetes Prevention Plan (MDPP).

Dental and Oral Health

CMS is also introducing coverage for some dental and oral health services that are integrally related to eligible medical services (for example, organ transplants, cardiac valve replacements, and valvuloplasty procedures), specifically:

- Dental exams and treatments required prior to or during treatment for head and neck cancers (primary or metastatic), regardless of the site of origin and/or initial modality of treatment.

- Certain dental services inextricably linked to other covered cancer-treatment services, such as chemotherapy, Chimeric Antigen Receptor T (CAR-T) cell therapy, and the use of high-dose bone modifying medications (antiresorptive therapy).

- Dental services that are not immediately required to eliminate or eradicate infection will not be paid, which means that dental implants, crowns, or dentures will continue to be ineligible for reimbursement.

This overview highlights only some of the proposed changes for 2024. CMS is also expanding reimbursement for in-home administration of COVID vaccinations to include three more vaccines: pneumococcal, influenza, and Hepatitis B. Clinical diagnostic lab tests (CDLTs) will have modifications to data collection and reporting periods, as well as a restriction on payment reductions (payments for the current year cannot be reduced when compared to the prior year). CMS will allow some providers that qualify but have missing documents a discretionary 60-day stay of enrollment status when enrolling with Medicare and Medicaid. (Providers will not be paid for services or items provided to Medicare patients during the stay, but it does allow them to submit missing paperwork and avoid having to re-start the enrollment process.) Criteria and policies for Medicare Shared Savings Program (MSSP) Accountable Care Organizations (ACOs) will also be refined.

While many changes are favorable, there are many additional changes that concerned providers should be aware of. We recommend reviewing both the AMA (American Medical Association) Summary (here) and the CMS proposed rule (here) for comprehensive insights. The AMA is particularly concerned about proposed changes to the Merit-based Incentive Payment System (MIPS) and has written to Congress (here), pushing for statutory reforms to improve and address fundamental issues with the program.

Don’t forget: CMS seeks comments on the proposed rules with a deadline of September 11, 2023. Make your voice heard!

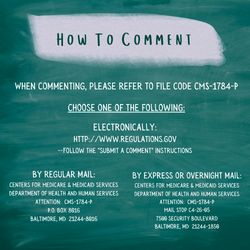

CMS instructions for commenting:

When commenting, please refer to file code CMS–1784–P.

Comments, including mass comment submissions, must be submitted in one of the following three ways (please choose only one of the ways listed):

- Electronically.You may submit electronic comments on this regulation to http://www.regulations.gov . Follow the “Submit a comment” instructions.

**We found this direct link: https://www.regulations.gov/document/CMS-2023-0121-1282

- By regular mail.You may mail written comments to the following address ONLY: Centers for Medicare & Medicaid Services, Department of Health and Human Services, Attention: CMS–1784–P, P.O. Box 8016, Baltimore, MD 21244–8016.

Please allow sufficient time for mailed comments to be received before the close of the comment period.

- By express or overnight mail.You may send written comments to the following address ONLY: Centers for Medicare & Medicaid Services, Department of Health and Human Services, Attention: CMS–1784–P, Mail Stop C4–26–05, 7500 Security Boulevard, Baltimore, MD 21244–1850.